After a hiatus of 5 years, I finally decided to restart my blog by valuing Bumble, a key player in the sprawling online dating space. The company has been around 2014 but went public in Feb 2021 and raised $2.2 Billion with investor expectations propelling the stock price to almost 2x of the IPO asking price. However, shareholder returns have witnessed a steep decline over the last year shaped by reality of business fundamentals along with macro headwinds. With the 2021 financials and 2022 10-Q filing out a few days back, I put my valuation hat on and drive the intrinsic valuation journey of the company by linking the business narrative and numbers and hopefully mitigating my bias in the process.

Company background

Bumble started in 2014 as an alternative to the widely popular Tinder app which revolutionized the dating app scene by bringing the quintessential "swipe feature". Interestingly, the company's CEO worked for Tinder due to differences and collaborated with founder of Badoo, another dating app, to launch the company) The company's value proposition is simple: given the unpleasant experiences and unwanted advances faced by females on dating apps, only female users can initiate conversations in heterosexual matches. This was a deliberate attempt to distinguish from Tinder, which over the years has gained the notorious distinction of being the "hook-up app". Studies have also backed up Bumble's focus on female user experience: a 2019 survey showed women across most age groups are far more likely to be at the receiving end of offensive statements and unsolicited pictures.

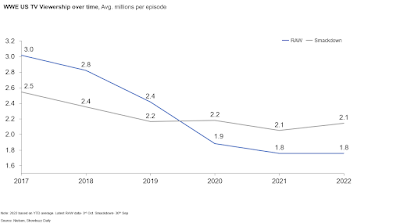

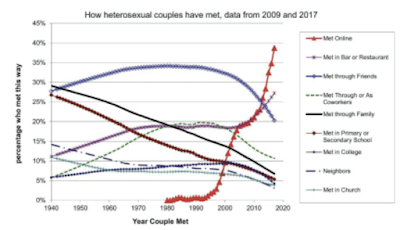

While the female centric focus resonated with users, the paradigm shift in lifestyle and consumer behaviour tailwinds further accelerated adoption rates across online dating industry over the last decade. With technology getting more intertwined with our lives along with higher penetration of smartphone and internet access, there has been a significant shift with couples ditching traditional ways of meeting- 2 out 5 couples met through online platforms.

Shareholder returns and operating performance

To get a quick performance overview, I start with looking at the shareholder returns post listing. Stock price has plummeted over the last year with Bumble losing almost 70% of it's IPO price and underperforming the broader market whereas it's main rival Match group has declined by almost 33%. Market expectations have become more measured as the resurgence of COVID-19 and lockdowns have kept users at home along with more spotlight on paying users and conversion rate. There has been a spike in the stock price post Q1 F22 results with the company exceeding wall street expectations on addition of new paying users.

Bumble and sister app Badoo essentially operate on a subscription ("freemium") model: the service is free to use but users have to pay for premium features and in-app purchases. Subscription ranges from 7 days to 180 days and in-app purchases allow both subscribers and non-subscribers to leverage on specific features to boost matches. Apart from the dating profile, there is also the BFF feature for platonic connections and Bizz for professional networking. Badoo follows a similar approach and is more popular across Europe and Latin America.

Revenue growth trajectory has been strong with an increase of more than 2x over last 4 years. However, the path to profitability has been volatile, after capitalising R&D costs and adjusting for non-operating items. The key operating metric here is paying subscribers average revenue per paying users (ARPPU). The stock price has spiked post Q1 2022 results with market rewarding the higher than anticipated total paying users of 3.0 Mn. Note that while Bumble has a better user monetisation and conversion compared to Match, they lag on profitability with high operating costs tied to selling and advertising through digital channels. Also, while the number of Badoo subscribers are higher than Bumble, the value of a bumble user is more than double with ARPU of $30 vs $13 for Badoo. While this drags the overall monetization, another key factor would be the split of users across geographies and change over time as pricing variations come into play. For e.g. a Bumble user in the US pays $19.99 per month whereas in India it's less than $10 per month. Unfortunately, this information is not disclosed by the company across filings but the geography split gives a directional sense of the delta in ARPPU for Bumble vs Badoo- a typical lifetime premium access for Bumble costs $249 vs $60 for Badoo which operates majorly in Europe and Latin America.

Industry diagnostic: Into the datingverse

To get some perspective on the potential market opportunity for Bumble, I looked (google searched) at the size of the global dating industry. The size of the online dating industry in 2020 was estimated to be $5.3Bn with North America accounting for 40% of the global dating market.

Note that the global market is expected to grow faster than North America over the next few years benefitting from the increase in digital penetration. The market is highly competitive with

dating apps galore based on regions, demographics and sexual orientation. The largest player in the industry is Match Group. With a mind boggling portfolio of 45 apps (incl. websites) and serving wide spectrum of users, they capture almost 50% of the global market share with revenues of $2.9 Billion (7 out of 10 top apps are owned by Match). The standouts apps and direct competitors to Bumble are Tinder and Hinge. Tinder has been the leader in dating apps and the first mover advantage of inventing the "swipe culture" has yielded significant gains with annualized growth of 42% over last 5 years . Hinge was acquired in 2017 and it's value proposition of meaningful relationship and "Designed to be deleted" tagline has gained popularity with revenues surging 2x over last 3 years.

Based on my understanding of Bumble's business and the industry/competitive landscape, my overarching narrative for the company is summarised in the following themes:

+ Competitive advantage: Fading faster than expected? While Bumble had steadfastly positioned women making the first move as their key differentiating factor vs competitors, there are signs that this might not be the only core strategy endgame with the tacit introduction of Bumble compliments (5 compliments where a user irrespective of gender can make the "first move" to compliment on your profile along with swipe). With 2 out of 3 users on the platform identifying themselves as male and increasing competition from Match, the strategic direction might include "men making the first move" implicitly.

+ Paying users: Macro headwinds to add growth pressure Bumble has maintained an impressive user conversion rate to paying users. However, with increasing stress globally spending due to higher inflation and interest rates, discretionary companies like Bumble will be highly sensitive to cutback in overall consumer spending along with increase in cost of capital. Interestingly, Bumble claims it's potential market size might be as large as streaming services. Although (which is outlandish to say the least), the stagnant or declining user growth across both industries might be the actual overlap in the future.

+ BFF: Platonic relationships might be the key after all Another driver of growth apart from the dating user base could be the BFF feature. Embedded in the broader dating app, the Bumble BFF provides opportunity to create ang engage communities across different cohorts for networking etc. This might create another additional growth opportunities and enhance user monetisation. But is it proprietary and what stops Match and rest of the competitors to launch something similar?

+ The Badoo factor: Strategic fit or returns laggard While Badoo accounts for ~ 40% of total paying users (1.2M) with a large footprint across Europe and Latin America, it's average revenue per paying user is less than half of Bumble and is a drag on returns. Moreover, the recent quarterly filing indicates a loss of 106K subscribers with a substantial portion attributed to the war in Ukraine. With the acquisition of Fruitz (a dating app popular with millennials in Europe), the strategic narrative for Badoo remains questionable. Currently, it seems like the higher Bumble revenue growth is subsidising Badoo users but this might make the profitability pathway more treacherous going forward

+ Low switching costs: No App to rule the all? One of the perils in the dating app industry is to cultivate a loyal user base. While Bumble and Hinge have been successful to some extent, the fact of the matter is that people use multiple apps at the same time and whichever works first wins. Also, there is a niche of apps which cater to different demographics and preferences. I did a simple test to check this out: downloaded 3 apps, kept my distance for potential matches less than 1 km and started swiping left and right. Unsurprisingly, I was bumping into similar people across these apps. While this test is based on N=1 and is largely unscientific, user retention will be a hard thing in the dating app industry with no one size fits all approach.

The Bumble Narrative

"Bumble is an online dating company which will continue to differentiate itself through it's female centric strategy. It will consolidate its position as one of the largest but not dominant players in the dating app space globally and generate higher margins through higher paying user conversion. The company will continue to reinvest in technology and risk of failure remains low. However, growth momentum will be challenged by high competition, macroeconomic pressures and changing consumer preferences"

Crunching the numbers

+ Revenue growth- To estimate the revenue growth for Bumble, I start with the market size estimates of the dating app market. Currently, Bumble has a 13% market share based on the market size of $6 Bn in 2021 Match's share of 50% in 2021. I give Bumble a market share of 20% in year 5 for Bumble i.e. revenues of $2.0 Billion based on expected market size of $9.8 Bn. This leads to annualised growth rate of 26% (vs 29% historical) for the high growth phase and 3% growth rate in perpetuity after year 10. How high is this assumption? If I assume Match's market share to remain constant at around 50%, the annualised growth for them would be 13% per annum based on a higher start base of $3.0 Bn. Therefore, while I am comfortable giving Bumble a higher growth rate during the high growth phase, I am implicitly assuming that they will continue to play second fiddle to Match and it's portfolio of apps.

+ Operating margins- Currently, the adjusted operating margin excl. one-off items and capitalised for R&D is at 8% (even though the non-GAAP margin is supposedly in high 20's by adding back stock based comp). For the end-state, I assume a pre-tax operating margin of 28.5% in year 10 which is in-line with the average industry margin and also corresponds to the largest player in the market i.e. Match. Essentially, this implicitly assumes Bumble's to continue to sustain/increase payer conversion over time. The profitability trajectory follows a linear increase towards the target margin over the 10 year forecast period.

+ Reinvestment- The proxy for reinvestment would be capital turnover i.e. for every dollar of capital how much does the company generate in sales. Bumble's capital efficiency is high as they operate on a low asset base and most of the balance sheet is tied up in goodwill. Currently, the sales to capital ratio is 3.4x which I assume as constant over the first 5 years and gradually transitions to 2.0x based on the nature of the business and capital productivity. Post year 10, the reinvestment is driven by an implicit perpetuity ROIC assumption of 22% in line with industry average.

Cost of Capital

With rising interest rates and tougher macro environment, the cost of capital for Bumble is ~ 9.6%. Note that the company has considerable debt on the books as well which has a below investment grade rating and bulk of the debt is due after 5 years. While this is a red flag, I have assumed that the company will be able to meet it's obligations and incorporated no chance of failure. The cost of capital transitions to ~ 9% in year 10 and beyond which is the median cost of capital for US firms.

From operating value to equity value

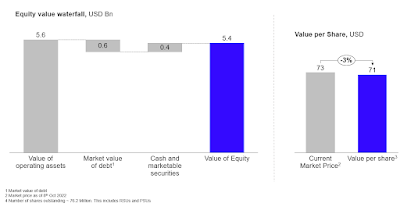

Using a 10 year explicit forecast period, I project out the cash flows with the first first 5 years of high growth, transition period from year 6-10 and stable growth period post 10. For the terminal value, growth is capped at the current risk free rate i.e. 2.7%, industry average ROIC of ~ 22% and cost of capital of ~ 9%. The value of operating assets is $6.5 Billion. Subtracting out debt, minority interest and adding back cash and equivalents leads to a value of equity of $5.4 Billion. Taking out the value of options and dividing by the shares outstanding gives me a value per share of $28 which is ~ 27% lower than the current share price of $38.

Factoring in the uncertainty

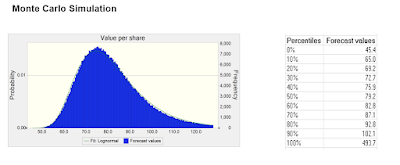

To capture the volatility in my key assumptions, I did a Monte Carlo simulation by assigning distributions to overall market size (lognormal), market share (triangular) and operating margin in year 10 (uniform). This helps me in incorporating the wide values around these key variables rather than just point estimates. After 1 Million simulations, the median share price of $26 is in line with my base case value of $27. Based on my assumptions, the current market price is already around 85th percentile of the distribution. Would I buy the stock at this price? I don't think so- maybe when it is below the median price of $27 or there is a significant change in the narrative. Based on my current narrative and link to numbers, the stock is overvalued by ~ 27%.

Final thoughtsBased on my story for Bumble and the bridge to numbers, the current intrinsic value is low versus the prevailing market price. I think the real test for the company will be over the next few months- with global inflationary pressures and impending drop in global consumer discretionary spending, will the company be able to maintain it's growth trajectory and accelerate path towards profitability? The impact of these macro shifts might influence and possibly pivot my narrative for the dating app industry and Bumble as an investment. The next steps would be to look out for new information in the quarterly earnings and watch out for any company narrative shifts/breaks. Till then, I'll sit back and swipe left on this investment.

Bumble valuation model link

Note: The content on this blog reflects the personal views of the author and should not be considered as an investment advice or recommendation.