After valuing a wine company in my last post, I traverse the media and entertainment space and zoom in on the wrestling behemoth WWE- a company which triggers nostalgia and a trip down memory lane to school days where the discussion among friends (often heated) was whether the shows are scripted or not. Enthralled as a young consumer with iconic characters and entertaining over the top storylines, it's time now to leverage the valuation lens and dissect the business and the numbers. WWE has been in the news recently and not for the right reasons- there have been allegations of misconduct by the CEO which has led to forced changes in the top management. However, the market has largely shrugged off such concerns with the stock rebounding post these revelations and generating year-to-date shareholder returns of ~ 35%. Is this scandal stemming out of larger governance issues or is the company an attractive proposition based on the numbers and narrative? It's time to enter the ring and build the value journey of the pioneer in "wrestling sports entertainment".

The Rise of an Empire

WWE's beginning goes back to 1950s when it was started by Jess McMahon as Capitol Wrestling Corporation under the umbrella of National Wrestling Alliance which also included other wrestling corporations. The real inflection point for the company came in the late 1970s when Vince McMahon Sr. ceded control to his son Vince K. McMahon who eventually bought him out and renamed the organisation as WWF. Vince's vision to take wrestling national through TV and pay per views ushered in the start of golden era in the 80s with wrestlers like Hulk Hogan becoming household names. The launch of Monday night Raw and Smackdown in the subsequent decade along with new talent pipeline and rising stars like Dwayne "The Rock" Johnson and Stone Cold Steve Austin further cemented WWF's position in sports entertainment. While competition heated up and some talent defected to WCW, the company continued it's ascendancy by publicly listing in 1999 and eventually acquiring WCW in early 2000's to become the largest Wrestling Sports Entertainment company in the world.

While the operating model has evolved over time, the company breaks down it's entertainment business into three revenue streams as per latest 2021 10K:

+ Media- The largest division which primarily includes licensing fees from distribution of Raw, Smackdown and NXT. This segment also includes pay-per-view and licensing fees from domestic distribution of WWE network content through Peacock streaming service in collaboration with NBCU along with advertising and sponsorship.

+ Consumer Products- Merchandising of WWE products i.e. video games, apparel and toys with revenue generation through licensing and direct to consumer sales.

+ Live Events- This segment consists of revenue from ticket sales of domestic and international live event touring schedules and travel packages with live events .

Shareholder returns and operating performance

Given the long public history of WWE, I start by looking at the share price trajectory over time and compare it to the broader index and sector. The price movement across last two decades can largely be broken down across 3 time horizons:

+

The "Meh" Phase (2002 to 2012)- Shareholder returns prior to 2012 are nothing to write home about with the company slightly underperforming the index and S&P 500. While the company signed new license agreements with NBCUniversal during this time period and earnings met or exceeded wall street expectations, shareholder value creation became stagnant as a cut in dividend and drop in pay-per view and live events over this decade reflected in the market expectations.

+

The Surge and the fall (2012-2020)- The price surge first began in 2013 based on speculation of a new domestic TV deal till 2019 with NBCUniversal with analysts anticipating an increase by 2-3x in value vs previous deal and an increase in subscriber base for WWE network (OTT platform for online streaming) to ~ 1 Million subscribers. However, the

stock price plummeted by ~ 50% when the final deal negotiated was significantly lower than expectations and subscriber count fell way short of target. The exact same story repeated itself in 2018- the impending broadcast deal renewal next year with major networks became the anchor point for price spike. While the company delivered this time with a 3.5x increase in value for the new 5 year agreement with Fox and USA network, an influx of bad news in 2019 i.e. quarterly loss due to absence of talent, struggle to complete a

TV rights deal in Middle East and surprise ouster of key executives alienated Wall Street and drove the decline of ~ 50% from it's 52 week high. In spite of the fall, the company comfortably outperformed the sector and broad market over this time horizon.

+

The Pandemic era (2020-2022)- The onset of COVID-19 had a significant impact on live events with decline in price reflecting the market drawdown in March 2020. However, the company was able to mitigate some of the impact with government in Florida classifying the business as "Essential Services" which enabled production of shows behind closed doors. WWE also made a

strategic pivot in 2021 to shut down WWE network in US and license programming to Peacock, the NBC streaming service at a deal valued at more than $1 Billion for 5 years. The upside trajectory post COVID-19 has been largely volatile but market has rewarded the company for series of earnings outperformance driven by tv rights fees and resurgence in live event sales even after the misconduct episode (more on that later).

The operating metrics of the company over last five years throw up some interesting insights. The single digit revenue growth and decline in revenue from live events even before the pandemic corresponds to drop in stock price over the same period. The renewed domestic licensing deal for domestic distribution in US under media segment propel overall revenue growth and spike in operating margins. The media revenues increase over time based on contractual escalations and pivot to online streaming through Peacock, the company has witnessed resurgence in merchandise sales and ticket sales post pandemic and higher margins across these segments. While the company has made efforts to expand it's geographic presence in countries like India and Saudi Arabia, it primarily remains a US company with 80% of revenue generation from North America.

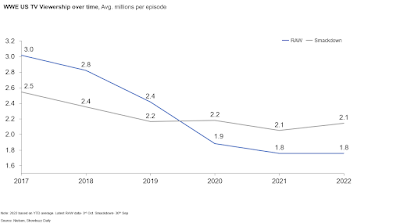

In terms of viewership, the trends across it's product offerings are not ideal. RAW and Smackdown have witnessed decline in viewership over last 5 years with RAW in particular dropping by almost 30%. While this coincides with the broader decline in TV viewership and the shift of consumers to streaming services, the pre-pandemic slide has also been attributed to lack of consumer engagement on storylines and character development. On the streaming front, WWE network was able to garner 1.2 million subscribers but the challenging economics of the online streaming business eventually made the network shutdown in the US and licensed content to Peacock, the NBCU service.

The Hush Money Saga

WWE has never been a poster child for exemplary governance standards. In fact, the company has been plagued with poor protection for shareholder interests over time which does not inspire confidence as a shareholder. The below page captures multiple corporate governance red flags for investors:

If you are a WWE shareholder, the illusion of shareholder interest protection and power to hold managers accountable quickly dissipates based on the above data. While the company scores terribly on overall score and audit/risk along with shareholder rights on the relative ISS scorecard vs industry, I think the kicker is the split class of shares. Class B shares with a voting power of 10x vs class A are effectively owned by Vince McMahon and his family either directly or through trusts. Moreover, there is also a conversion trigger to class A if any of these class B shares are transferred outside of McMahon family. Is WWE only company to do it? The answer is no- there are examples in tech where companies (Snap, Facebook, Google) have blatantly done this and got away with it. However, the fact remains that you or I as a potential shareholder essentially don't have a say in how the company is run. In other words, the interest of the McMahon family will supersede the interests of common stockholders in running the business.

Won't institutional shareholders step in and vote against the management when required? They don't have a great track record to prove it- research (Source: Damodaran) has shown that institutional investors have largely sided with the management on resolutions. Something that stood out from the data was activist investor ownership- 22% of stock is owned by activist investors based on varying degree of activism. While these are database classifications, is the threat of potential activist action real for WWE? Like with all things, it falls into the realm of possibility but we are yet to see any evidence on that front. Also, given the stock and performance jump recently, I doubt an activist takeover would be a reasonable proposition.

The Scandal: Favours, Payments and NDAs

The news of sexual misconduct broke out in June this year when the

Wall Street Journal reported that the board is investigating a secret settlement of $3 Million involving CEO Vince McMahon and an ex-employee with whom he had an affair. The board's investigation started in April found out other instances of hush money with former WWE female employees and subsequent non-disclosure agreements executed to prohibit discussion of the relationship which also involved accusations against John Laurinaitis, the head of talent relations at WWE. The annotated stock chart highlights these revelations along with share price movements over this time period:

The initial knee jerk reaction of the market is evident with stock price declining by 3% post initial reports in Mid June (interestingly, there are insider trading allegations as well with ~ 2 million shares being sold just before publication of the WSJ article). The true extent of the scandal became evident in the following weeks and is startling- $12 million of payments were made over almost last two decades accompanied by strict non-disclosure agreements leading to resignation of Vince McMahon as CEO and Chairman. This is truly a watershed moment in WWE's history- a larger than life CEO who has been synonymous with the company and the brand over decades. Moreover, Vince was heavily involved on the content creation side and personally intervened to create story lines for characters. The step down was also prompted by regulatory scrutiny with SEC and Federal prosecutors launching an investigation. Did the stock price plummet? Market expectations were largely immune and there was no backlash either from the business partners of the company or Wall Street. In fact, Wall Street was busy drafting the next storyline for the company- a potential

acquisition target post departure of Vince and truly following the motto of "Show me the Money". And the stock price is up by ~ 5% since the initial WSJ report came out- the strong Q2 FY22 earnings release diminished by overall macro environment but brushing aside any larger cultural concerns across organisation for now.

The WWE Story: Summer Slam or Pinfall?

Based on the company history, operating performance and the recent governance issues, my business story for the company will revolve across the following key themes:

+ Media rights: Gold rush to continue WWE's revenue stream is dominated by TV licensing deals and the company has established a sizeable viewership base over time. In spite of the ratings decline, the generated content is an attractive proposition for broadcasting companies as reflected by the 2019 US deal below negotiated at almost 3.6x in value vs the previous agreement. The company is also expanding clinching agreements outside US with a new multi-year

online streaming deal signed for Australia in September 2022. With the US rights to be renewed again in 2024, the jewel of the WWE empire will continue to rake in higher revenues and drive group profitability.

+ WWE Universe: The size trade off works The company's shutting down of WWE network as it's own strategy was a clear recognition that the plan to transition to a tech company model hadn't worked and it remains a content creation company. This should pay off in the long run- they don't have to keep reinvesting in technology as a streaming service and still get a share of the pie through the Peacock collaboration. From a content creation lens, would the company indirectly compete with the likes of Netflix and Disney Plus to draw eyeballs? WWE's business model borders more on entertainment rather than sports after all. I believe the potential market for WWE will continue to remain a small one compared to other content creation companies but not a bad thing necessarily- a small (on a relative basis) profitable market with a loyal user base is much better than a large footprint with mounting losses.

+ AEW: Resurrection of the competition All Elite Wrestling (AEW) has emerged as a WWE alternative with a simple value proposition: current pro wrestling has become too scripted with distractions galore and there is appetite for unscripted raw wrestling. The initial live event which included some of former WWE stars sold out in a few hours and subsequently a broadcasting deal was struck through TNT network (part of WarnerMedia). The jury is still out on whether unscripted shows can work on a regular basis but a serious competitor enough to challenge WWE has emerged after almost two decades of undisputed dominance.

+ Me, Myself and I: Vince McMahon company forever? Even with Vince no longer the CEO or Chairman, the holding structure and corporate governance scorecard makes one thing quite clear: WWE is a company run of, by and for the McMahon family. It also represents one of those larger than life CEO scenarios where the distinction between the company and the CEO is non-existent. After all, Vince McMahon has been the face of the company for decades and heavily influenced character storylines and scripts. Will the influence diminish post departure? With Stephanie McMahon at the helm and the skewed voting rights through Class B stock ownership, WWE will continue to remain firmly under family control.

+ Women Wrestling: The next growth catalyst Women's wrestling has shown significant growth with WWE promoting new stars and positioning female wrestlers in the main match in WrestleMania, it's flagship annual event. With women sports events globally attracting more fans and sponsors, this could become a key enabler for the company to expand WWE Universe and further drive penetration among young demographic, especially female consumers.

+ Acquirer Who? The M&A whispers Post the scandal and Vince McMahon's departure, there have been speculation on the company being a potential M&A target. But it is hard to see who will be the potential suitor and what will be the strategic fit: in the new era of slowing growth, rising interest rates and overleveraged corporate balance sheets, the chances of acquisition remain slim for now. With a current enterprise value of around USD 7 Billion, significant firepower and alignment from the majority shareholders (no prizes for guessing who) would be required to takeover the company.

The WWE Narrative

"WWE is an entertainment company which will continue to dominate the professional wrestling space through it's established fan base. The company's competitive position will enable it to drive growth and profitability by monetising content through lucrative licensing arrangements on TV networks and online streaming. Reinvestment needs will be in line with the industry averages and there is no imminent default risk. The dilution of shareholder rights through poor corporate governance will be a drag on value creation over time"

Crunching the Numbers

+ Revenue growth- To estimate future revenues for WWE, I split the growth trajectories into two time periods: Pre-Media rights renewal in 2024 and post. For the first two years, the growth is in line with the five year CAGR of ~ 7% from 2018-22. For the next 3 years of the high growth phase, the growth rate is 12%- an assumption that WWE would be able to attract broadcasters and charge top dollar for licensing deals, particularly in the US domestic market. This is also broadly in line with the growth spike in 2019 when the current broadcasting arrangement was signed. Post the high growth phase, growth would decline and eventually be in line with current risk free rate in perpetuity. From an absolute dollars standpoint, revenues grow by more than 2x over the forecast horizon and translate into $2.9 Billion in Year 10.

+ Operating margins- The current pre-tax operating margins for WWE are ~ 25%, a significant step up and ~2x of pre-pandemic margins. I assume this to continue forward and margins to stay at 25%- in line with aggregate margins for the media and entertainment industry. This assumption might be on the lower side- the revenue spike should translate into higher profitability after 2024. While wrestling with the uncertainty, I will keep the margin profile as status quo and attempt to capture the variation in my simulation analysis.

+ Reinvestment- The proxy for reinvestment would be capital turnover ratio i.e. sales divided by invested capital. The current sales to capital ratio for WWE is 2.0 as the company has high capital efficiency which means that for every dollar invested in the business, the company generates $2 in sales. I assume the ratio to stay constant at 2.0 over the forecast period- the company has high capital efficiency historically and most of the funds are invested in PP&E and leases. Content creation costs remain low as live event programming costs are expensed when events are first broadcast. The capital turnover assumption translates into an average return on invested capital (ROIC) of ~ 39% over forecast period, significantly higher than the cost of capital for WWE.

Cost of Capital

The current cost of capital is ~ 9.2% for the company, with capital largely funded through equity. In the rising interest rates environment due to inflation, this captures company's higher required rate of return on existing projects. The cost of capital would gradually transition to median cost of capital for US firms in stable growth phase.

From Operating Value to Equity Value

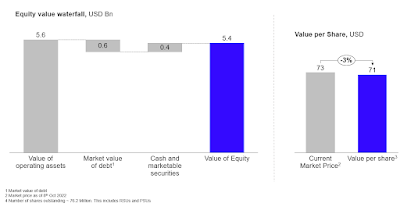

Using a 10 year explicit forecast period, I project out the free cash flows for first 5 years of high growth, transition period from year 6-10 and stable growth period post 10. For the terminal value, growth is capped at the current risk free rate i.e. 3.9%, ROIC of ~ 25% and cost of capital of ~ 9%. This is where I bring the corporate governance part of my story into numbers- I reduce the ROIC-WACC spread in perpetuity from 38% to 25% to account for the ongoing governance issues in the company. Can it be another number than 25% and are there other ways to incorporate this? Absolutely! I think the key is to bring it into the numbers on an ongoing basis and account for the fact that the focus of corporate decisions would be to serve family interest. The impact on value is not substantial- it knocks of ~ $200 Million of value as at an already high ROIC, it's growth and margin assumptions that are key value drivers for the company. Discounting the expected free cash flows at the cost of capital, the value of operating assets for WWE is $5.6 Billion Taking out debt, adding back cash and marketable securities and dividing by the shares outstanding gives me a value per share of $71/ share which is ~ 3% lower than current share price of $73/share.

Factoring in the uncertainty

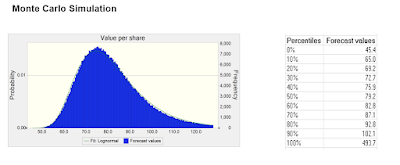

Rather than drawing insights just from point estimates, I attempt to capture the variation in my key assumptions through Monte Carlo Simulation by assigning probability distributions to revenue growth from year 3 to year 5 (Triangular), operating margin in year 10 (Uniform) and cost of capital (Normal). This helps me in incorporating the wide values around these key drivers . After 500K simulations, the median share price is $79/share, which suggests a potential upside of ~ 10%. If you believe that WWE will be able to further monetize content and translate it into higher margins, there are scenarios where the value can range from $80 to $100 at the higher end of spectrum. The short answer is that based on fundamentals, there is merit in expecting stock outperformance vs current market price.

Final Thoughts

While WWE's character narratives are blown out of proportion, the current business story is actually backed up by the numbers- it's a company structured around monetising content with a large and loyal fan base. However, the next set of challenges for the company are around the corner that warrant swift action rather than complacency- departure of Vince McMahon, decline in TV viewership, rise of AEW as a challenger and diminishing returns on talent development vs previous generation superstars. In spite of his departure, Vince McMahon will continue to exert his influence through his shareholding and daughter Stephanie who is the Co-CEO. I believe markets have largely overlooked the corporate governance story as WWE has delivered on shareholder returns and operating performance with some blips across the way- will they be so generous in the post Vince era if the company doesn't meet implied expectations? As we find that out in the next chapter of the company's journey, Delivering on their tag line of "Then, Now, Forever, Together" might be imperative now more than ever.

Note: The content on this blog reflects the personal views of the author and should not be considered as an investment advice or recommendation.

No comments:

Post a Comment